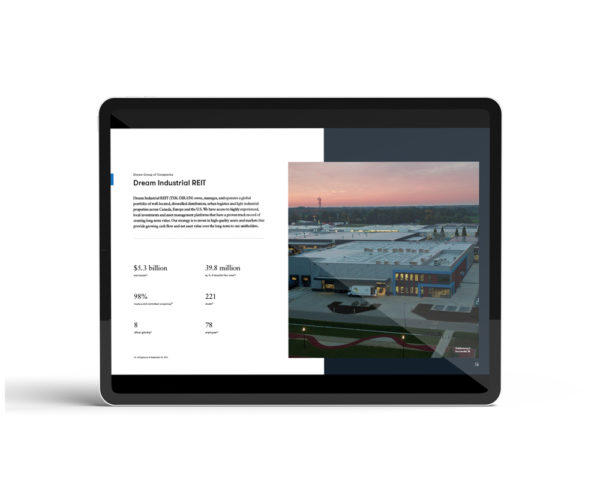

Dream Industrial’s goal is to deliver strong total returns to its unitholders through secure cash flows underpinned by its high-quality portfolio and an investment grade balance sheet as well as driving growth in its net asset value and cash flow per unit.

2023 Highlights

-

3.6 million sf

3.6 million sfof completed green building certifications, an increase of 123% in GLA compared to 2022

-

3.7 MW

3.7 MWof renewable energy capacity added by completing 3 solar projects in the Netherlands and 1 solar project in Alberta

-

$1.4 million

$1.4 milliongenerated in revenue from renewable energy production

-

Completed

Completedinaugural Principles for Responsible Investment (“PRI”) submission and achieved scores above the PRI median in two out of three modules(1)

-

Completed

Completedsecond annual reporting requirements for the Net Zero Asset Managers (“NZAM”) initiative(1)

-

Launched Climate Resiliency Working Group

Launched Climate Resiliency Working Groupto standardize an asset-level approach to climate risk adaptation

-

2.5 million

2.5 millionin green leases executed

-

$69,000

$69,000in charitable donations

(1) DRM completed the submission on behalf of the Dream group of companies, including DIR.UN.

ESG Scorecard

| Indicator | 2019 Baseline | 2022 | 2023 | YoY% Change | % Change from Baseline |

| Energy | |||||

| Energy Consumption (ekWh)(2) | 39,877,285 | 38,945,824 | 36,852,772 | -5% | -8% |

| Annual MWh of Renewable Energy Produce (MWh)(3) | 2,507 | 12,077 | 22,859 | 89% | 812% |

| Cumulative On-site Solar PV System Capacity (kW)(3) | 2,433 | 19,489 | 25,685 | 32% | 956% |

| Cumulative Percentage of Total Floor Area with On-site Renewable Energy Generation (%)(3) | 4% | 12% | 16% | 4% | 12% |

| Water | |||||

| Water Consumption (m³)(2) | 284,744 | 218,444 | 340,773 | 56% | 20% |

| Annual Water Savings from Climate-controlled Irrigation (litres)(4) | 15,667,000 | 10,467,000 | 18,107,000 | 73% | 16% |

| GHG Emissions(2)(5) | |||||

| Scope 1 GHG Emissions (tCO2e) | 4,435 | 3,544 | 2,338 | -34% | -47% |

| Scope 2 GHG Emissions (tCO2e) | 5,020 | 3,386 | 5,438 | 61% | 8% |

| Total Scope 1 and 2 GHG Emissions (tCO2e) | 9,455 | 6,930 | 7777 | 12% | -18% |

| Other Indicators | |||||

| Cumulative GLA with LED Lighting Upgrades (sf)(6) | – | 11,320,546 | 14,690,768 | 30% | – |

| Cumulative GLA of Portfolio with Green Building Certifications (sf) | 472,123 | 1,601,582 | 5,175,305 | 223% | 996% |

| Percentage of Eligible Portfolio GLA with an Energy Rating(7) | see note | 46% | 62% | 16% | – |

| Percentage of Portfolio GLA with Sustainable Roofs (%)(8) | see note | 23% | 23% | 0% | – |

| Number of Electric Vehicle (“EV”) Charging Stations(9) | see note | 136 | 258 | 90% | – |

| Indicator | 2020 | 2021 | 2022 | 2023 |

| Employees(11)(12) | 75 | 86 | 103 | 136 |

| Voluntary Turnover Rate(13) | see note | 16% | 14% | 14% |

| Women Employees(14) | 62% | 52% | 50% | 49% |

| Women Managers(15) | 53% | 53% | 52% | 52% |

| Women Executives(16) | 33% | 33% | 33% | 33% |

| Indicator | 2020(17) | 2021(18) | 2022(19) | 2023(20) |

| Women Directors | 25% | 25% | 25% | 38% |

| Independent Directors | 75% | 75% | 75% | 75% |

(1) Excludes co-owned properties in the US Portfolio and Dream Summit JV. Please refer to Supplemental Disclosures for more detail including data coverage and sources of emission factors.

(2) Excludes data from assets in the European portfolio.

(3) Includes estimations, third-party and tenant-owned systems on DIR.UN’s properties.

(4) Data is collected from 46 buildings in Calgary.

(5) GHG emissions are calculated in accordance with the World Resource Institute Greenhouse Gas Protocol. Calculations in this table capture activities DIR.UN has direct and indirect operational control over: Scope 1 emissions generated directly from its operations, including heating properties; Scope 2 emissions indirectly associated with generation of purchased electricity.

(6) Historic numbers have been updated to exclude T5 lighting and US Portfolio GLA to stay consistent with future reporting.

(7) Represents 100% of GLA of properties in ENERGY STAR Portfolio Manager or that have an EPC rating. Changes in years are due to acquisitions and dispositions of assets.

(8) Sustainable roofs include cool roofs and green roofs with vegetation.

(9) Includes EV chargers owned or installed by tenants or third parties.

(10) Includes only employees 100% dedicated to DIR.UN (including Dream Industrial Europe Advisors Coöperatieve UA, Dream Industrial Netherlands Property Management B.V., Dream France Advisors SAS, Dream Summit Industrial Management Corp) and excludes employees on unpaid leaves of absence (e.g., permanent disability, long-term disability, parental leave) and interns.

(11) Numbers represented as total headcount, not full-time equivalent.

(12) Includes permanent part-time employees.

(13) Turnover is calculated as a percentage of average employee headcount.

(14) Includes employees at all levels.

(15) Managers include Manager level and above.

(16) The Chief Executive Officer, Chief Financial Officer and Chief Operating Officer of DIR.UN are employees of Dream Asset Management Corporation. However, for the purposes of representation here, they are included under DIR.UN.

(17) Board composition as at December 31, 2020.

(18) Board composition as at December 31, 2021.

(19) Board composition as at December 31, 2022.

(20) Board composition as at December 31, 2023.

Environmental

Dream Industrial has a responsibility to manage and mitigate its overall impact on the environment. It recognizes that sustainability and impact investing are fundamental to doing business and a key driver of creating long-term value for its stakeholders. Dream Industrial’s approach to sustainability includes increasing energy efficiency throughout its portfolio, engaging tenants, lowering operational costs, incorporating energy management initiatives into its capital expenditures, and future-proofing assets against the impacts of climate change.

Building Certifications

Green building certifications help Dream Industrial incorporate a range of sustainable features into its global portfolio of properties and provide tenants, investors and lenders with credible proof points of the value of sustainability features in buildings.

In 2023, Dream Industrial made significant progress on its commitment to increase the number of green building certifications in the portfolio and executed on its commitment to obtain green building certification for all new developments including:

- LEED Silver Certification on a 154,000 sf new development in Caledon, Ontario

- The German Sustainable Building Council (“DGNB”) Gold Certification on a 241,000 sf expansion in Dresden, Germany

- LEED Silver Certification on a 43,000 sf expansion in Richmond Hill, Ontario

In 2023, Dream Industrial achieved and exceeded its 2025 target to obtain green building certifications for an additional 2.7 million sf (includes LEED, BREEAM, ZCB, BOMA or DGNB) vs. the 2020 baseline.

Net Zero Development Program at 220 Water Street

Dream Industrial’s net zero development project at 220 Water Street located in Whitby, Ontario is comprised of two buildings currently undergoing construction and slated for completion by 2025. The project involved working with an independent consultant to conduct comprehensive whole building energy and GHG emissions simulations, value engineering various design options and conducting a life-cycle assessment for GHG emissions.

The design strategy for 220 Water Street delineates a clear pathway for the asset to attain CaGBC’s Zero Carbon Building Performance Certification in the future:

- Approximately 70% of all building systems are designed to be electric;

- High-efficiency upgrades, including HVAC systems and roof insulation will be implemented;

- The building design includes a reinforced roof, giving it the capacity to install a rooftop solar PV system to generate a minimum of 5% of the site’s energy consumption.

- Increased electrical capacity to accommodate a future transition to an all-electric building.

Pre-planning for these net zero upgrades in the construction design minimizes the need for costly renovations and tenant disruptions in the future, underscoring Dream Industrial’s commitment to progression in its net zero strategy.

Renewable Energy

In 2023, Dream Industrial completed three rooftop solar projects in the Netherlands and one solar project in Alberta, representing a total capital investment of $4 million and 3.7 megawatts (“MW“) of system capacity. As at the end of 2023, Dream Industrial has completed a cumulative total of 18 renewable energy projects representing a total system capacity of 14 MW, which are estimated to save approximately 115,000 tonnes of carbon dioxide equivalent (tCO2e)(1) over the lifetime of the projects. Dream Industrial owns and manages these solar panel installations directly as well as the associated revenue stream, which exceeded $1.4 million in 2023.(2)

As at the end of 2023, construction is underway on four additional solar projects – two projects in the Netherlands and two projects in Alberta – representing 7 MW of renewable energy capacity. In addition, feasibility assessments are underway on ten potential projects in Ontario and Europe.

(1) Emission Factor released in the National Inventory Report during the year of completion is used in the estimation. The values are not updated annually to reflect updated and changes to the emission factors.

(2) Includes revenue from rooftop solar systems that were in place upon building acquisition.

Social

Dream Industrial has committed to promoting the highest standards of social responsibility throughout the organization and aims to improve the lives of everyone who works there. Employees come from a wide range of backgrounds and experiences, bringing many valuable skills and perspectives to the team. The people Dream Industrial hires all have one thing in common: they hold shared values and contribute to company culture.

Green Lease Program

Dream Industrial has adopted a green lease as its standard lease across Canada and has integrated green lease considerations into its lease negotiations in Europe. The green lease program includes tenant commitments to energy disclosures, low carbon construction practices, the purchase of on-site renewable energy (if available), energy efficiency engagement and training, and cost recovery clauses for energy efficiency upgrades.

Green Lease Leaders In 2023, Dream Industrial received Platinum level recognition from the Green Lease Leaders program during the Better Buildings, Better Plants Summit,

held by the Institute for Market Transformation and the U.S. Department of Energy’s Better Buildings Alliance. The improvement from Gold to Platinum level is attributable to training and engagement sessions that were held in 2023 with internal leasing teams and external brokers on energy efficiency, climate change, and net zero building design. Dream Industrial’s progress on the development of building-level net zero transition plans and the implementation of energy management best practices also supported the year-over-year advancement from Gold to Platinum level. Dream Industrial will continue to integrate innovative and leading sustainability initiatives into its leasing program.

Dream Industrial Gender Breakdown(1)

(1) Includes only employees 100% dedicated to DIR.UN and excludes employees on unpaid leaves of absence (e.g. permanent disability, long-term disability, parental leave) and interns. Includes employees employed by Dream Industrial Management Corp., including Dream Industrial Europe Advisors Coöperatieve UA, Dream Industrial Netherlands Property Management B.V., Dream France Advisors SAS and Dream Summit Industrial Management Corp.

(2) Includes employees at all levels.

(3) Includes Managers and above.

(4) Executives of DIR.UN are employees of Dream Asset Management Corporation however the CFO of DIR.UN is a woman, while the CEO and COO are men.

Governance

As part of the ESG Framework, Dream Industrial links ESG considerations to executive goals and compensation.

Sustainability at DIR.UN is managed by the following:(1)

-

Board of Trustees

+

The Dream Industrial Board has delegated such oversight to the Governance, Compensation and Environmental Committee

-

Governance, Compensation and Environmental Committee

+

Oversee approach to environmental, social and governance matters

-

Chief Executive Officer

+

Highest-level executive with oversight over ESG and impact matters, including sustainability and climate change, at

Dream IndustrialWorks with the Chief Financial Officer to provide leadership over the sustainability strategy and oversee adoption of the

ESG Framework -

ESG Executive Committee (Members of the Executive Leadership team from each Dream entity)

+

Receive regular updates from the Sustainability and ESG team on behalf of all departments and the sustainability

working groupsAdopt ESG Framework for Dream Industrial

Communicate sustainability strategy and commitment across company and key external stakeholders

Delegate implementation to Dream Industrial’s Sustainability and ESG team

Reports to the Governance, Compensation and Environmental Committee

-

Green Finance Committee

+

A cross-departmental committee co-chaired by the CEO and CFO and made up of senior executives representing the following departments at Dream Industrial: Finance, Sustainability and Portfolio Management

Established to provide oversight of Dream Industrial’s Green Bond Framework and to identify sustainable financing options

-

Sustainability and ESG Team

+

Embed sustainability strategy and commitment across company and with key external stakeholders

Oversee the implementation of the ESG Framework for each Dream entity

Manage portfolio sustainability initiatives including building certifications, energy, water and waste management and monitoring, as well as strategic initiatives

Meet quarterly with the ESG Executive Committee

-

Sustainability Working Groups

+

Responsible for advancing sustainability initiatives and activities at company and property level

Includes three working groups covering the following focus areas: Green Property Operations, Employee Engagement and Tenant Engagement

Includes representatives from central functions, regions, and properties

Report regularly to the Sustainability and ESG team

-

Investment Committee

+

Review the investment’s Acquisition Checklist and approve investments that meet both financial and impact goals

Hold the project team accountable to achieve goals and create impact

(1) The responsibilities set out in this section are for illustrative purposes only, reflect certain relevant ESG matters, and do not purport to reflect the full extent of responsibilities or the full mandate of any of the board, committees or teams referred to in this section.

Disclosure Frameworks

-

Principles for Responsible Investment ↗The United Nations Principles for Responsible Investment (PRI) is the world’s leading responsible investor collaboration. It supports its signatories to incorporate ESG factors into their investment and ownership decisions. Signatories commit to follow PRI’s six principles and report annually on their progress through the PRI Reporting Framework. Dream Unlimited, on behalf of the Dream group of companies, became a signatory to the PRI in 2021, and completed the inaugural submission in 2023.

Principles for Responsible Investment ↗The United Nations Principles for Responsible Investment (PRI) is the world’s leading responsible investor collaboration. It supports its signatories to incorporate ESG factors into their investment and ownership decisions. Signatories commit to follow PRI’s six principles and report annually on their progress through the PRI Reporting Framework. Dream Unlimited, on behalf of the Dream group of companies, became a signatory to the PRI in 2021, and completed the inaugural submission in 2023. -

United Nations Principles for Responsible Investment ↗The Sustainable Development Goals (SDGs), also known as the Global Goals, were adopted by all United Nations Member States in 2015 as a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity by 2030. There are 17 goals in total which provide a shared blueprint to achieve the 2030 goals. The Dream group has identified relevant SDGs throughout its investment strategy and considers how projects may contribute to the achievement of these goals. In particular, the Dream group of companies is dedicated to building safe, resilient, inclusive, and sustainable cities – expressed by Goal 11.

United Nations Principles for Responsible Investment ↗The Sustainable Development Goals (SDGs), also known as the Global Goals, were adopted by all United Nations Member States in 2015 as a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity by 2030. There are 17 goals in total which provide a shared blueprint to achieve the 2030 goals. The Dream group has identified relevant SDGs throughout its investment strategy and considers how projects may contribute to the achievement of these goals. In particular, the Dream group of companies is dedicated to building safe, resilient, inclusive, and sustainable cities – expressed by Goal 11. -

Taskforce on Climate-related Financial Disclosures ↗In 2021, Dream Unlimited became an official supporter of the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations. To align with TCFD recommendations and enable appropriate oversight, Dream Unlimited hosted board education sessions to increase understanding of ESG and climate-related risks and opportunities. To strengthen oversight, responsibility for ESG and impact matters was formally integrated into corporate board governance. Scenario analysis was also completed, which is a corporate strategy and risk/opportunity identification exercise to evaluate how Dream Unlimited prepares for the implications of climate change and climate-related financial disclosures.

Taskforce on Climate-related Financial Disclosures ↗In 2021, Dream Unlimited became an official supporter of the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations. To align with TCFD recommendations and enable appropriate oversight, Dream Unlimited hosted board education sessions to increase understanding of ESG and climate-related risks and opportunities. To strengthen oversight, responsibility for ESG and impact matters was formally integrated into corporate board governance. Scenario analysis was also completed, which is a corporate strategy and risk/opportunity identification exercise to evaluate how Dream Unlimited prepares for the implications of climate change and climate-related financial disclosures. -

Net Zero Asset Managers ↗The Net Zero Asset Managers (NZAM) initiative is an alliance of global asset managers committing to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with the global efforts to limit warming to 1.5 degrees Celsius. As one of the first Canadian companies to join the NZAM initiative, Dream Unlimited, on behalf of the Dream group of companies, made its initial target disclosure in 2022. In 2023, 69% of the Dream group of companies’ total assets under management were committed to be managed in line with net zero by 2050, an increase from 61% in 2022.(1)

Net Zero Asset Managers ↗The Net Zero Asset Managers (NZAM) initiative is an alliance of global asset managers committing to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with the global efforts to limit warming to 1.5 degrees Celsius. As one of the first Canadian companies to join the NZAM initiative, Dream Unlimited, on behalf of the Dream group of companies, made its initial target disclosure in 2022. In 2023, 69% of the Dream group of companies’ total assets under management were committed to be managed in line with net zero by 2050, an increase from 61% in 2022.(1)

(1) Assets under management as of December 31, 2023.

Environmental

Courtney Park Net Zero-Ready Development

Tenants are setting ambitious net zero commitments and seeking spaces that enable them to align with corporate goals, deliver operational cost savings and achieve net-zero operations. To meet its tenant’s shared net zero goals, Dream Industrial is constructing a net zero-ready industrial warehouse redevelopment at Courtney Park.

Courtney Park is an industrial warehouse redevelopment project that is currently under construction and scheduled to be completed in 2024. Dream Industrial engaged an independent consultant to develop a net zero roadmap by conducting an in-depth GHG audit, creating a calibrated energy model, and completing a life cycle assessment.

Additional features to support reaching net zero include:

- Designing 70% of all building systems to be electric

- Implementing high efficiency upgrades including HVAC systems and roof insulation

- Installing a reinforced roof to support the addition of solar panels

To reduce embodied carbon at Courtney Park, Dream Industrial has actively sought opportunities to recycle and re-use equipment. Throughout the construction and development process, the project management teams identified items to be repurposed for the new development such as steel, doors, concrete slabs, and mechanical systems. In addition to reducing embodied carbon, re-using materials can also result in cost savings. Coordinating the re-use of materials to realize these dual benefits is enabled through the synergy and cooperation of Dream Industrial’s development and property management teams.

This pilot project provides Dream Industrial with an industrial warehouse net zero-ready roadmap for future new industrial warehouse developments. In addition, Dream Industrial is undertaking an architectural design review to assess how low carbon materials, such as mass timber and low carbon concrete, can reduce the embodied carbon of an industrial warehouse development.

Once completed, the Courtney Park project is expected to receive Canada Green Building Council’s (CaGBC) Zero Carbon Building Standard certification, which certifies the building is net zero design ready.

Environmental

Tenant Collaboration on LED Retrofits

In 2022, Dream Industrial engaged directly with tenants to collaborate on LED retrofits. This involved an outreach program to increase tenant awareness of the environmental and financial benefits of LED technology and provide them with an opportunity to upgrade lighting during their lease term. Using this approach, Dream Industrial teams successfully collaborated with a major tenant to upgrade the lighting in their space, totalling over 220,000 sf.

Social

Tenant Engagement

In 2022, Dream Industrial improved building amenities, accessibility, and EV infrastructure at select properties, in response to its tenant outreach and engagement program, including:

- At 100 East Beaver Creek, in Richmond Hill installed a walkway to provide tenants and visitors with increased access to the building, on-site EV charging stations and transit routes.

- At Alberta Park in Edmonton installed an accessibility ramp and washrooms which services a 26,638 sf two-storey building currently occupied by an organization that supports the local community.

- At 45A and 45B West Wilmot Street, Richmond Hill and 55 Horner Avenue, Etobicoke in Ontario installed picnic tables in tree-covered areas to enhance tenant outdoor spaces at 2 buildings.

As the transition to net zero continues to support the need for EV charging infrastructure, Dream Industrial’s EV portfolio increased by 46%, to 136 EV chargers. Installing EV chargers futureproofs assets to future tenant needs, as Canada aims for 60 percent of passenger vehicle sales to be EVs by 2030, with all sales being electric by 2035.

Sustainability Reports

- Green Financing +

-

Previous years

+

-

2023 Dream Sustainability Report

↗ -

2022 DIR.UN Sustainability Report

↗ -

2022 Dream Group of Companies Sustainability Report

↗ -

2021 DIR.UN Sustainability Update Report

↗ -

2021 Dream Group of Companies Sustainability Update Report

↗ -

2021 DIR.UN Sustainability Report

↗ -

2020 – 2021 Dream Group of Companies Sustainability Report

↗ -

2019 DIR.UN Sustainability Report

↗ -

2019 Dream Group of Companies Sustainability Report

↗

-

-

Policies

+

Declaration of Trust

Dream Industrial REIT’s Declaration of Trust governs our operations and includes such topics as investment guidelines and operating policies, financing restrictions, units and distributions, and the responsibilities and obligations of the Trustees.

Disclosure PolicyThe objective of our disclosure policy is to ensure that communications to the investing public about Dream Industrial REIT are timely, factual and accurate, and disseminated in accordance with all applicable legal and regulatory requirements. The policy covers topics including trading restrictions and blackout periods, confidentiality, and designated spokespersons. This policy applies to all trustees, officers and employees of Dream Industrial REIT and its subsidiaries.

Code of ConductOur Code of Conduct (the “Code) is our statement of the values and principles that guide us in our day-to-day business activities. The keystones are: integrity, respect, fairness, accountability and transparency. The Code supports our commitment to operate our business at the highest level of legal, moral and ethical standards. The Code applies to all trustees, officers and employees of Dream Industrial REIT and subsidiaries.

Whistleblower PolicyAt Dream Industrial REIT, we are steadfast in our commitment to maintaining the highest business and personal ethical standards by dealing openly and honestly with our investors, tenants, suppliers and employees. With our Whistleblower Policy we marry this commitment to that of securities laws and regulations with respect to accounting standards and internal control standards. We have contracted EthicsPoint Inc., an independent service provider, to manage any complaints or concerns on our behalf. This service reports directly to the Audit Committee of Dream Industrial REIT and is available seven (7) days a week, 365 days a year. Any concerns may be reported directly, confidentially, and, if preferred, anonymously, through www.ethicspoint.com

Majority Voting PolicyThe Trust has a majority voting policy, requiring that each Trustee nominee receive the support of a majority of the total number of votes cast by the unit holders entitled to elect such Trustee nominee, failing which such Trustee shall submit his or her resignation to the Board for consideration.

Diversity Inclusion & Advancement CommitmentAs one of Canada’s leading real estate companies, we always invest with purpose, embracing creativity and diversity, passion and innovation, while positively impacting our communities and the world around us.

Board Diversity PolicyDream seeks to maintain a Board comprised of talented and dedicated trustees whose skills and backgrounds reflect the diverse nature of the business environment in which Dream operates. Accordingly, the composition of the Board is intended to reflect a diverse mix of skills, experience, knowledge and backgrounds, including an appropriate number of women trustees.

Environmental PolicyThe Environmental Policy sets out Dream Industrial REIT’s objectives and goals as it relates to protection of the environment. It allows us to identify products, activities and services that minimize adverse impacts on the environment and to introduce them where most effective in our business.